Table of Contents

1. What is VAT Tax?

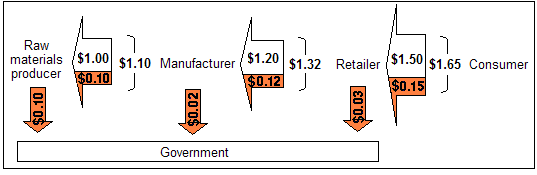

VAT (Value Added Tax) is a consumption tax levied on goods and services at each stage of production or distribution, from raw materials to final sale. VAT is added incrementally, meaning it’s applied every time a product increases in value. Ultimately, the end consumer bears the cost, as businesses can reclaim VAT on their expenses, but the tax is passed down through the supply chain to the retail price.

2. Why VAT Matters in Today’s Economy

VAT plays a crucial role in modern economies by generating revenue for governments without taxing savings or investments directly. This tax model encourages consumer spending and, when implemented effectively, provides a stable income source for government funding. VAT is easier to administer than some other taxes, making it popular among governments worldwide.

3. Countries Where VAT System Is Applied

Many countries globally implement a VAT system, with varying rates depending on their economic strategies and fiscal policies. Here are some regions where VAT is prevalent:

1. European Union (EU)

The EU standardizes VAT across its member countries with a minimum rate requirement, though actual rates vary. For instance:

- Germany:

- Standard VAT Rate: 19%

- Reduced VAT Rate: 5% to 7% on essential goods.

- France:

- Standard Rate: 20% – applies to most goods and services

- Reduced Rate: 10% – applies to certain goods and services, including:

- Necessities such as food, books, and medical products

- Sales of certain kinds of medicines and transport of persons

- Super-Reduced Rate: 5.5% – applies to: Food Products, Subscriptions to Gas And Electricity, and Sales of Books, Products, and Services provided to disabled persons.

- Spain:

- General VAT: 21% (applies to most goods and services)

- Reduced VAT: 10% (applies to certain goods and services, such as cultural activities, transport, and electricity)

- Super-reduced VAT: 4% (applies to necessities like essential foodstuffs and subsidized housing)

- VAT-free: 0% (applies to specific goods and services, such as masks and hand sanitizer, financial products, and healthcare products)

2. United Kingdom

The UK levies a VAT with a standard rate of 20%, with reduced rates on specific categories:

- Standard Rate: 20%

- This applies to most goods and services

- Reduced Rate: 5% for certain energy-efficient products.

- Applies to certain goods and services, such as:

- Some health products

- Fuel

- Heating

- Car seats for children

- Applies to certain goods and services, such as:

- Zero rate: 0%

- This applies to most food, books, and children’s clothing

- Note: Although no VAT is charged, businesses still need to report these sales on their VAT return

3. Asia

- China:

- Standard VAT rate: 13%

- Reduced VAT rate: 9% (applying to transportation and postal services, basic telecommunication services, leasing or sale of immovable property, transfer of land use rights, and sale of agricultural products, chemical fertilizer, books, tap water, and mineral products)

- Reduced VAT rate: 6% (applying to certain goods and services, such as sale of used cars from May 1, 2020 to December 31, 2027)

- Zero-rated VAT: export of goods and services (except for certain types of services)

- Japan:

- Standard VAT rate: 10%, This rate applies to most goods and services, including imports.

- There is a reduced rate of 8% applicable to certain goods and services, including:

- Food and beverages (except when purchased in restaurants and alcoholic drinks)

- Newspapers published more than twice a week (under subscription contracts)

4. Africa

- Africa’s VAT rates vary significantly between countries, ranging from 7.5% in Nigeria to 20% in Morocco and Madagascar.

- South Africa:

- Standard VAT Rate: 15% VAT rate. With zero-rated and exempt items. Qualified purchasers can benefit from a VAT refund mechanism for certain goods at a rate of 15%.

- Morocco and Madagascar:

- Both countries have a VAT rate of 20% on goods and services.

- Cameroon:

- The VAT rate is 19.25%.

- Nigeria:

- The VAT rate is 7.5%, the lowest on the African continent.

- Egypt:

- VAT rate in Egypt is 14%. This rate applies to most goods and services, including:

- Advertising services, which were previously exempt but are now subject to VAT at the rate of 14%

- Imported products, including second-hand equipment, are subject to VAT at 14% of the customs/import duty paid

- Machinery and equipment used in the production of goods or provision of services (except for buses and passenger vehicles): 5% VAT rate

- Exports outside Egypt: 0% VAT rate

- VAT rate in Egypt is 14%. This rate applies to most goods and services, including:

4. VAT Rates by Region and Goods

1. Europe

The EU mandates a minimum VAT rate of 15%, although many countries adopt higher rates:

- Luxury Goods: 20-25% in various countries.

- Basic Necessities: Reduced VAT, as low as 5-10%.

2. North America

The United States doesn’t implement VAT, opting for state sales taxes instead. However, Canada uses a Goods and Services Tax (GST), which is similar to VAT.

3. South America

VAT rates in South American countries generally range between 10-20%.

5. The Impact of VAT on Different Goods and Services

The VAT rate often varies based on the type of product:

- Essential Goods: Typically have reduced VAT rates to lower costs for consumers.

- Luxury Items: Higher VAT rates are applied to items considered non-essential.

6. Benefits of VAT for the Economy

- Revenue Generation: VAT is a significant source of income for governments.

- Encourages Production Efficiency: Since VAT is applied at each stage, businesses may streamline processes.

- Transparency: VAT allows clear insight into how much tax is being paid.

7. Challenges and Criticisms of VAT

While beneficial, VAT has some downsides:

- Regressiveness: It impacts lower-income individuals more heavily.

- Administrative Costs: Setting up VAT systems requires robust administrative processes.

- Inflationary Effect: High VAT rates may drive up prices.

How VAT is Calculated: A Simple Example

Let’s break down a VAT calculation example to better understand how it works. Imagine a company that produces and sells leather bags, and the VAT rate is set at 20% in their country.

- Raw Material Supplier: The supplier sells raw materials (e.g., leather) worth $100 to the manufacturer and charges 20% VAT. The manufacturer pays:

- Cost of materials: $100

- VAT at 20%: $20

- Total paid by manufacturer: $120

- Manufacturer: The manufacturer uses leather to make bags, which it sells to a retailer for $200. The VAT is calculated as follows:

- Selling price to retailer: $200VAT at 20%: $40Total billed to retailer: $240

- Retailer: The retailer adds a markup and sells the bag to a consumer for $300. Here’s the breakdown:

- Selling price to consumer: $300

- VAT at 20%: $60

- Total paid by consumer: $360

In this way, VAT is collected and remitted to the government at every stage, but only the end consumer ultimately bears the cost.

Global Overview of VAT Rates and How They Vary

VAT rates are not the same worldwide. Here’s a closer look at how VAT rates differ across continents and some notable countries within them.

Europe

Europe has some of the highest VAT rates globally, largely due to the European Union’s VAT standards, which require a minimum VAT rate but allow individual countries to set higher rates if desired.

- Denmark: 25% (one of the highest in Europe)

- Switzerland: 7.7% (one of the lowest in Europe)

- Ireland: 23% (with reduced rates for food, books, and medical items)

Asia

Countries across Asia have adopted varying VAT rates based on their economic structures and policy objectives:

- India: Known as the Goods and Services Tax (GST) and varies between 5% and 28% depending on the goods category.

- Thailand: A flat rate of 7% on most goods and services.

- Philippines: 12%, with exemptions for certain medical and educational services.

Middle East and North Africa

In recent years, the Middle East has introduced VAT to diversify its revenue sources, especially in oil-dependent economies.

- Saudi Arabia: Recently increased from 5% to 15% due to economic reform strategies.

- United Arab Emirates: 5%, introduced as part of the Gulf Cooperation Council VAT framework.

North America and South America

Most North American countries don’t have a VAT system, with the United States opting for state sales taxes instead. Canada, however, applies VAT-like GST at a federal level, combined with a provincial sales tax in certain provinces.

In South America:

- Argentina: 21% VAT, with lower rates for essential goods.

- Chile: 19% VAT applied on a broad range of products and services.

The Pros and Cons of VAT Systems

Benefits of VAT

- Revenue Generation: VAT provides a steady income for governments without directly taxing income, which can reduce avoidance.

- Encourages Transparency: Since VAT is recorded at each stage of production, it offers clear insight into the supply chain.

- Less Evasion: VAT is generally harder to evade than income tax because it’s applied at multiple points in the supply chain.

Drawbacks of VAT

- Regressive Impact: VAT affects low-income consumers more, as a higher percentage of their income goes toward VAT-paid goods.

- Complexity for Businesses: VAT requires detailed record-keeping, especially for businesses that may need to reclaim VAT paid on expenses.

- Potential Inflation: High VAT rates can raise the prices of goods and services, potentially impacting consumer spending.

Steps for Consumers and Businesses to Manage VAT

- Consumers: Be aware of the VAT percentage included in the price of goods, especially on larger purchases. Some countries have VAT refunds available for international travelers.

- Small Businesses: Ensure compliance with VAT rules. Many governments provide resources or consultants to assist small businesses with VAT registration, collection, and refunds.

- Large Corporations: Implement efficient systems for tracking VAT paid and collected to streamline the refund process.

How VAT Impacts Online Shopping and Cross-Border Transactions

With global e-commerce on the rise, VAT becomes increasingly significant for online purchases:

- For Consumers: VAT is often included in the total price of online goods. Some countries apply VAT on goods purchased from foreign retailers, impacting the final cost.

- For Businesses: VAT registration may be required in countries where goods are sold online. Businesses must keep track of VAT rates and make adjustments based on the destination country of the buyer.

Key Takeaways on VAT Systems Worldwide

VAT is a widely used tax system due to its efficiency and revenue-generating potential. However, its implementation varies significantly by country and is influenced by factors like economic structure and government policy objectives. Consumers should understand the VAT they’re paying, and businesses need efficient systems for VAT compliance. Ultimately, VAT impacts everyone, from manufacturers and retailers to consumers, making it an essential part of modern taxation systems worldwide.

Frequently Asked Questions About VAT

1. What is the difference between VAT and sales tax?

Sales tax is charged at the final sale only, while VAT is applied at each stage of production.

2. Which countries don’t use VAT?

The United States primarily uses sales tax instead of VAT.

3. How does VAT affect small businesses?

Small businesses can reclaim VAT on expenses but may find compliance challenging due to complex reporting.