Value Added Tax (VAT) is a critical component of many businesses, affecting pricing, compliance, and profitability. Whether you are a budding entrepreneur or simply seeking clarity on VAT, understanding how to calculate it accurately is essential. This comprehensive guide will walk you through the basics, methods, and tips for calculating VAT effectively.

Table of Contents

What is VAT?

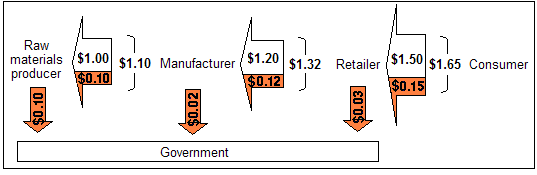

VAT, or Value Added Tax, is a consumption tax levied on goods and services at each stage of production or distribution. It is paid by the end consumer but collected and remitted to the government by businesses.

Key Components of VAT Calculation

To calculate VAT accurately, you need to understand the following:

- Taxable Amount: This is the net price of the goods or services before VAT is added.

- VAT Rate: The percentage rate at which VAT is applied, which varies by country and product type.

- VAT-Inclusive Price: The total price, including VAT.

- VAT-Exclusive Price: The price excluding VAT.

Step-by-Step Guide to Calculate VAT

1. Calculating VAT Amount from a Net Price

To determine the VAT amount from a VAT-exclusive price, use the formula:

VAT Amount = (Net Price × VAT Rate) / 100

For example, if the net price of an item is ₹10,000 and the VAT rate is 18%:

- VAT Amount = (₹10,000 × 18) / 100 = ₹1,800

- Total Price (Including VAT) = ₹10,000 + ₹1,800 = ₹11,800

2. Extracting VAT from a VAT-Inclusive Price

If you know the total price (inclusive of VAT), calculate the VAT amount using this formula:

VAT Amount = Total Price × VAT Rate / (100 + VAT Rate)

For example, if the total price is ₹11,800 and the VAT rate is 18%:

- VAT Amount = ₹11,800 × 18 / 118 = ₹1,800

- Net Price = ₹11,800 – ₹1,800 = ₹10,000

3. Reverse Calculation of VAT-Exclusive Price

To find the net price from a VAT-inclusive price:

Net Price = Total Price / (1 + VAT Rate / 100)

Using the same example with a total price of ₹11,800 and a VAT rate of 18%:

- Net Price = ₹11,800 / (1 + 18 / 100) = ₹10,000

Examples of VAT Rates Across Countries

- India: Ranges from 5% to 28% depending on the product or service.

- United Kingdom: Standard rate is 20%, with reduced rates of 5% for certain goods and services.

- European Union: Varies by country, generally between 17% and 27%.

Common Challenges in VAT Calculation

- Multiple Rates: Products and services may be taxed at different rates, requiring careful categorization.

- International Transactions: VAT rules for imports and exports can vary significantly.

- Exemptions and Zero-Rated Items: Certain items may be exempt or zero-rated, complicating calculations.

VAT Calculation Tools and Software

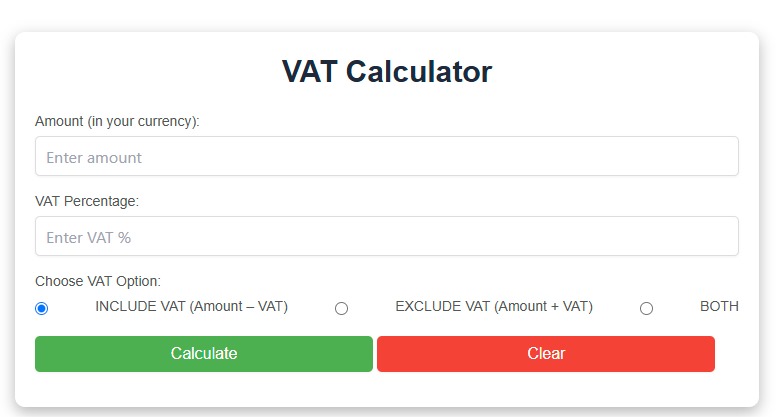

Several tools simplify VAT Calculation for businesses:

- VAT Calculators: Online tools allow quick VAT calculations based on input values.

- Accounting Software: Platforms like QuickBooks, Tally, and Xero integrate VAT calculations into broader financial management.

- Custom Excel Sheets: Tailored formulas in Excel can automate VAT computations for small businesses.

Benefits of Accurate VAT Calculations

- Compliance: Avoid penalties and legal issues by submitting correct VAT returns.

- Transparency: Communicate pricing to customers by breaking down VAT-inclusive and exclusive amounts.

- Efficiency: Streamlined calculations reduce errors and save time.

Practical Tips for VAT Management

- Stay Updated on Regulations: VAT rates and rules can change frequently.

- Organize Invoices: Maintain clear records of all sales and purchases for accurate VAT reporting.

- Use Digital Tools: Leverage technology for accurate and efficient VAT management.

FAQs

1. What is the difference between VAT and GST?

VAT is applied at every stage of production, while GST (Goods and Services Tax) is a unified tax system covering VAT, service tax, and other indirect taxes.

2. How often should VAT be filed?

This depends on the country’s regulations. Typically, businesses file VAT monthly, quarterly, or annually.

3. Are small businesses exempt from VAT?

Some countries allow exemptions or simplified schemes for small businesses with turnover below a specific threshold.

Pingback: A Comprehensive Analysis of Value Added Tax (VAT) and Its Economic Implications - vatcalculations.com

Pingback: What is VAT and How Does It Work? A Comprehensive Guide for Beginners - vatcalculations.com